Advanced Micro Devices Inc (AMD) has reported impressive earnings for the first quarter of 2023, with revenue exceeding expectations by $44.77 million to reach $5.35 billion.

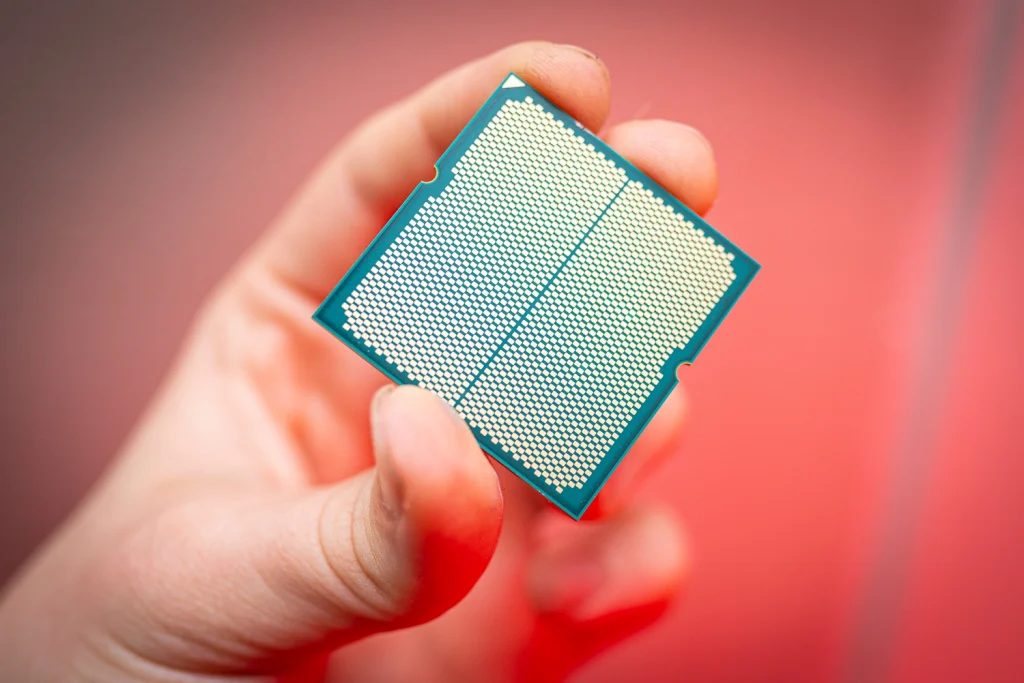

Due to the success of its Ryzen and EPYC processors, AMD has been acquiring market share in the high-performance computing market. AMD is well-positioned to capitalise on this trend as the demand for high-performance computation continues to grow.

In addition, AMD has expanded into new markets, such as gaming consoles and data centres. Its partnership with Microsoft to provide custom processors for the Xbox Series X and S has been a huge success, and its EPYC processors have been acquiring market share in the data centre sector. These new markets offer AMD additional revenue streams and contribute to the diversification of its business.

AMD is constantly introducing new products to expand its portfolio. Microsoft Azure, Google Cloud, and Oracle Cloud Infrastructure have announced new capabilities based on AMD\’s EPYC processors, demonstrating its leadership in confidential computing. In addition, the company has enhanced the capabilities of developers to create AI solutions utilising AMD products, including updates to the PyTorch Foundation\’s 2.0 framework. AMD has also expanded its presence in the telco industry, announcing a Telco Solutions testing facility and launching Zynq UltraScale+ RFSoC products to accelerate the deployment of 4G/5G radios in emerging markets to demonstrate its growing presence.

AMD has also expanded its portfolio of embedded processors to include potent, scalable options for a variety of embedded applications. Overall, the expansion of AMD\’s cloud sales and partnerships with leading cloud service providers demonstrates the company\’s growing presence in the data centre market. These developments, coupled with the company\’s continued innovation and expansion into new markets, position AMD for future.

| Sector | Electronic Technology |

| Industry | Semiconductors |

| Industry View | In – Line |

| Market Capitalization | $156.72B |

Earnings Insights & Expectations:Advanced Micro Devices Inc ($AMD)

Advanced Micro Devices Inc (AMD) reported strong Q1 2023 earnings, with revenue exceeding estimates by $44.77 million and reaching $5.35 billion. The company beat normalized EPS estimates by $0.04 with a reported EPS of $0.60, but missed GAAP EPS estimates by $0.09 with an EPS of -$0.09.

During the first quarter of 2023, AMD generated a cash inflow of $486 million from its operating activities, primarily due to cash collections from customers, payments for inventory purchases, and payments for employee-related expenditures. However, the company experienced net cash outflows of $1.2 billion from its investing activities, primarily due to purchases of short-term investments totaling $1.7 billion and purchases of property and equipment of $158 million.

AMD\’s financing activities resulted in a net cash outflow of $259 million during the first quarter of 2023, primarily due to common stock repurchases of $241 million and repurchases for tax withholding on employee equity plans of $21 million. Despite this, the company still expects to announce strong earnings for the upcoming quarter with an estimated revenue of $5.32 billion, and an EPS estimate of $0.58 on a normalized basis and $0.03 on a GAAP basis.

Discovering Growth Drivers:Advanced Micro Devices Inc ($AMD)

- AMD Reports Strong Growth in Q1 2023 Across Multiple Segments

- Embedded Segment Q1 2023: AMD\’s embedded segment experienced significant growth in Q1 2023. Key achievements included the launch of Zynq RFSoC products to accelerate 4G/5G radio deployments and the formation of AMD\’s first Telco Solutions Lab. Additionally, the company expanded its portfolio in the security, storage, edge server, and network markets with the launches of the AMD Ryzen 5000 and AMD EPYC 9000 embedded series processors.

- Gaming Segment Q1 2023: AMD\’s gaming segment also saw robust growth in Q1 2023. The company reported that semi-custom SoC revenue grew y/y, driven by strong demand for premium gaming consoles. Channel sell-through of RadeonTM 6000 and Radeon 7000 series GPUs increased q/q, and sales of the high-end Radeon 7900 XTX GPU were strong based on new RDNA 3 architecture and 5nm chiplet design.

- Client Segment Q1 2023: AMD\’s client segment launched the industry\’s fastest gaming processors with the AMD Ryzen 7000X3D series CPUs. In the mobile space, the first notebooks powered by AMD\’s \”Dragon Range\” CPUs launched to strong demand. The company also launched the \”Zen 4\”-based \”Phoenix\” AMD Ryzen 7040 series CPUs for ultrathin and gaming notebooks. Over 250 AMD Ryzen 7000 series notebooks are expected to launch this year.

- Data Center Segment Q1 2023: The company\’s data center segment saw significant growth in Q1 2023. AMD reported strong double-digit percentage y/y growth in cloud sales. Furthermore, the company launched 28 new AMD-powered instances, including multiple confidential computing offerings from major cloud providers such as Microsoft Azure, Google Cloud, and Oracle Cloud. Leading OEM providers also entered production on new \”Genoa\” server platforms, and the Max Planck Society announced plans to build the first EU supercomputer powered by 4th Gen EPYC CPUs and MI300 Instinct accelerators. In addition, PyTorch 2.0 framework now offers native support for AMD ROCm software.

- Overall , AMD\’s Q1 2023 results demonstrate the data center and embedded segments contribute to over 50% of revenue. Clearly, the growth of AMD\’s cloud sales and relationships with major cloud providers underscore the company\’s expanding presence in the Data Center market.

- Strong demand for high-performance computing products: AMD has been gaining market share in the high-performance computing market, driven by the success of its Ryzen and EPYC processors. The company\’s focus on innovation and performance has helped it to win over customers who are looking for high-quality products that can handle demanding workloads. As the demand for high-performance computing continues to grow, AMD is well-positioned to benefit from this trend.

- Expansion into new markets: AMD has been expanding into new markets, such as gaming consoles and data centers. The company\’s partnership with Microsoft to provide custom processors for the Xbox Series X and Series S has been a major success, and AMD\’s EPYC processors have been gaining traction in the data center market. These new markets provide AMD with additional revenue streams and help to diversify its business.

- Launch of New Products: AMD\’s Dominance in Confidential Computing: AMD is leading in confidential computing with Microsoft Azure, Google Cloud, and Oracle Cloud Infrastructure announcing new capabilities based on AMD EPYC processors.

- Efficient AI Solutions: AMD has expanded capabilities for developers to build robust AI solutions leveraging AMD products, including updates to the PyTorch Foundation\’s PyTorch 2.0 framework, which now offers native support for ROCm software. The latest TensorFlow-ZenDNN plug-in, which enables neural network inferencing on AMD EPYC CPUs, is also available.

- Alveo MA35D Media Accelerator: AMD has announced the AMD Alveo MA35D media accelerator to power a new era of live interactive streaming services at scale, featuring an integrated AI processor that dynamically adjusts video quality.

- Powerful and Scalable Embedded Processors: AMD has expanded its embedded processor portfolio with powerful, scalable offerings for a variety of embedded applications. The new AMD Ryzen Embedded 5000 Series processors deliver mid-range, scalable, and efficient performance optimized for \”always on\” networking firewalls, network-attached storage systems, and other security applications. Similarly, the new AMD EPYC Embedded 9004 Series processors bring performance and energy efficiency to embedded networking, security and firewall, and storage systems in cloud and enterprise computing, as well as industrial edge servers.

- Broadening Presence in the Telco Space: AMD has showcased its growing presence in the telco space, including announcing a Telco Solutions testing lab to support the validation of end-to-end AMD based solutions. The company has also launched Zynq UltraScale+ RFSoC products to accelerate the deployment of 4G/5G radios in emerging markets and expanded collaboration with Nokia to power Nokia Cloud RAN solutions. AMD is also helping communications service providers achieve their most stringent energy efficiency goals.

- New AMD Ryzen Mobile Processors: AMD Ryzen mobile processors are powering new commercial, consumer, and gaming experiences. The new AMD Ryzen Z1 and Z1 Extreme processors, featuring AMD RDNA 3 architecture-based graphics, bring ultimate portability and battery life to handheld PC gaming consoles, including the Asus ROG Ally. HPI announced hardware and software offerings for the hybrid workplace powered by next-gen Ryzen processors. HPI also announced the next-generation OMEN 16 and Victus 16 laptops featuring up to an AMD Ryzen 9 7940HS processor. Lenovo announced the Legion Slim 7 featuring up to an AMD Ryzen 9 7940HS processor, as well as additions to the Yoga lineup featuring AMD Ryzen 7000 Series processors. AMD partnered with HPI to co-engineer their Dragonfly Pro powered by custom AMD Ryzen 7 7736U processors. Framework introduced AMD-powered versions of both their Framework Laptop 13 and newly announced Laptop 16.

- Other Developments: AMD has announced the extension of a multi-year agreement with Samsung to bring multiple generations of high-performance, ultra-low-power AMD Radeon graphics solutions to an expanded portfolio of Samsung Exynos SoCs. AMD also announced the AMD Radeon PRO W7000 Series graphics, the first professional graphics cards built on the advanced AMD chiplet design to deliver leadership performance and unique features. Furthermore, AMD FidelityFX Super Resolution technology is now supported in 250 available and upcoming games, 110 of which support FSR 2, the latest update to the cross-platform temporal upscaling technology.

Valuation Overview: Advanced Micro Devices Inc ($AMD)

| Valuation Ratios | Current | 2023E | 2024E | 2025E |

| EV/ Sales | 6.66 | 7.47 | 7.16 | 7.29 |

| EV/ EBITDA | 38.63 | 26.78 | 22.21 | 20.90 |

| EV/ EBIT | 121.54 | 32.05 | 25.21 | 24.75 |

| Price/Earnings | 405.83 | 180.79 | 58.20 | 53.43 |

Buy access to valuation report on the stock and site wide access here.

Check out emerging investment themes here : Top AI Picks ; Fintech & Agtech ; Energy Transition , Digital Healthcare and Trending Tickers News Feeds

Check our Bill Gates and Bill Ackman’s latest portfolio updates.