General Dynamics Corporation (GD) kicked off 2024 with robust financial and operational performance, despite some challenges that slightly skewed the outcomes from their own ambitious targets. In the first quarter, the company reported earnings per share of $2.88 from revenues of $10.7 billion, marking an 8.6% increase in revenue year-over-year. Net earnings ascended by 9.5%, and the operating margin edged up by 20 basis points to 9.7%. These numbers are commendable and reflect the underlying strengths of General Dynamics\’ diversified business operations. However, despite these gains, the company fell short of its internal forecasts mainly due to delayed deliveries in the Aerospace segment. This delay was notably tied to the late certification of the G700 aircraft, which pushed the expected revenue and earnings realization beyond the quarter.

Table of Contents

- Stock Rating & Target Price

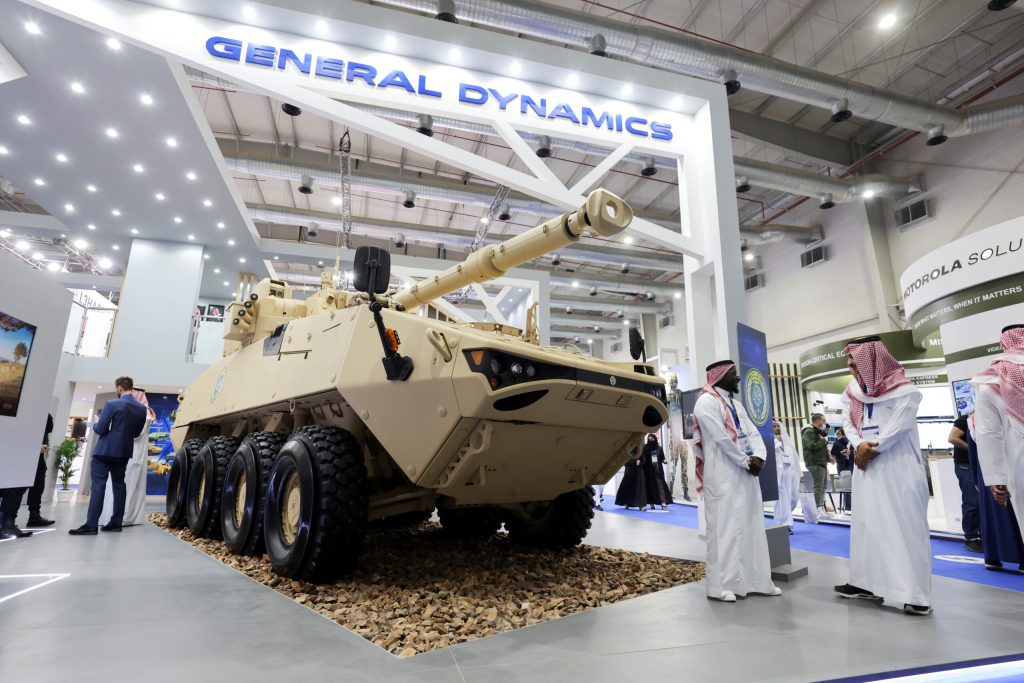

- Company Description

- Corporate Timeline

- Investment Thesis

- Key Performance Metrics

- Recently Reported Earnings vis-à-vis Market Expectations

- Quarterly Review

- Business Highlights

- Strategic Announcements & Outlook

- Fundamental Models Used

- Factors Affecting Performance or Key Growth Drivers

- Growth Analysis

- Quarter-over-Quarter (Q-o-Q) and Year-over-Year (Y-o-Y) Growth Analysis

- Historical Financial Statement Analysis & CAGR Trends

- Financial Performance Metrics

- Quarterly Key Financial Ratios and Performance Metrics

- Annual Financial Performance Analysis: Horizontal and Vertical Financial Analysis, Trends

- Financial Forecasts

- Annual Forecasts: Income Statement

- Annual Forecasts: Cash Flow Statements

- Net Debt Levels

- Valuation

- A Closer Look at DCF: Our Assumptions and Methodology

- Terminal Value Calculation

- Target Price Analysis

- Valuation Multiples

- Supplementary Valuation Analysis: Multiples Approach

- Scenario/Sensitivity Analysis

- Base Case

- Bull Case

- Bear Case

- Holistic Peer Review

- Financial Data

- Operational Metrics

- Valuation Multiples

- Altman Z-Score

- Ownership Dynamics

- Ownership Activity/ Insider Trades

- Ownership Summary

- ESG Considerations

- An analysis of ESG Risk Rating

- Key Personnel

- Key Professionals

- Key Board Members

- Key Risks Considerations

- Disclosures

Buy Full Research Report Here from the link attached : https://buy.stripe.com/7sI9DwfjZ1yPd5S7sy

See Our Research Library Here